Exactly How a 2D Payment Gateway Improves Protection and Performance in E-Commerce

Exactly How a 2D Payment Gateway Improves Protection and Performance in E-Commerce

Blog Article

A Comprehensive Look at the Performance and Advantages of Carrying Out a Payment Portal

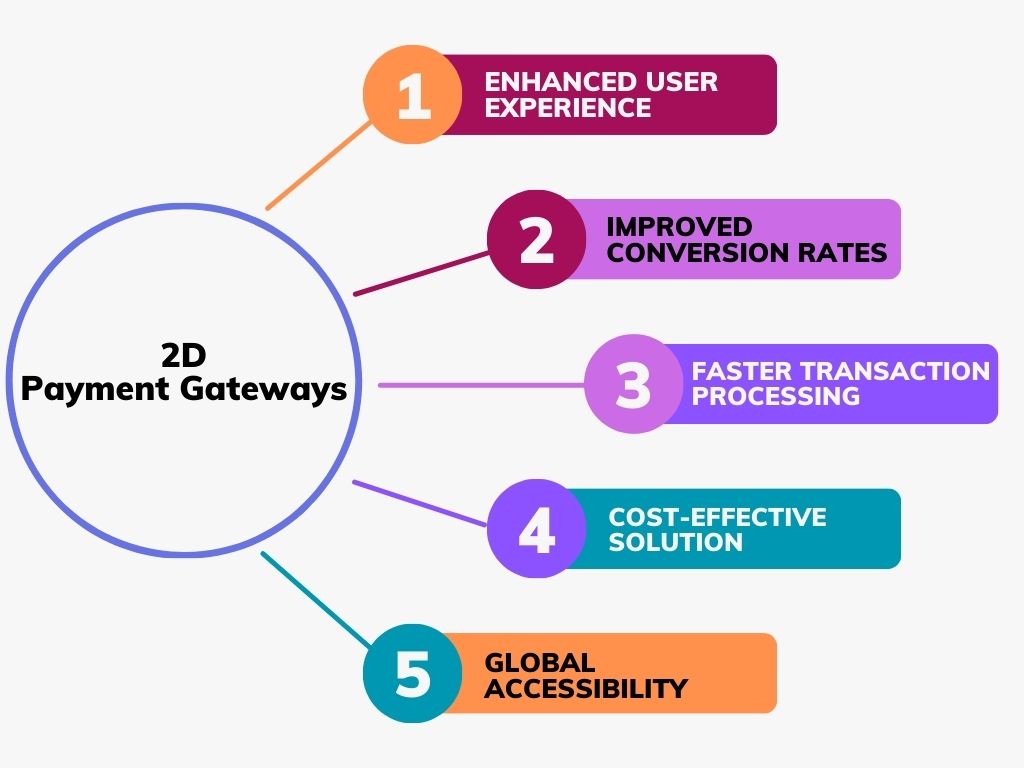

The application of a payment portal represents a critical advancement in the world of electronic transactions, offering organizations not just enhanced security yet likewise an extra efficient handling system. By incorporating functions such as multi-payment support and real-time purchase abilities, companies can substantially boost customer contentment while lessening the risk of cart abandonment. The ability to access detailed analytics can inform operational enhancements and calculated choices. The complete extent of advantages extends past these first benefits, elevating essential questions concerning the more comprehensive implications for business development and customer trust fund.

Recognizing Payment Gateways

The significance of modern shopping hinges on the smooth combination of payment portals, which offer as the important avenues in between vendors and consumers. A settlement entrance is an innovation that facilitates the transfer of details in between a repayment website (such as a site or mobile application) and the financial institution. This system makes sure that sensitive data, consisting of credit scores card details, is securely transmitted, hence maintaining the integrity of the deal.

Payment portals are crucial for refining on-line settlements, allowing consumers to total purchases efficiently while offering sellers with an automated service for taking care of economic deals. They support numerous settlement approaches, including charge card, debit cards, and alternate payment alternatives, accommodating diverse consumer preferences.

Moreover, payment gateways enhance the overall shopping experience by providing functions such as real-time deal handling and fraudulence detection devices. Understanding the performance of settlement gateways is vital for any kind of company looking to thrive in the competitive landscape of on-line retail.

Key Attributes of Payment Entrances

A thorough understanding of payment entrances additionally involves acknowledging their crucial attributes, which dramatically enhance both functionality and individual experience. Among the primary functions is purchase handling rate, which enables vendors to total sales rapidly, consequently minimizing cart abandonment prices. In addition, repayment entrances help with a multitude of settlement approaches, consisting of credit rating cards, debit cards, and electronic pocketbooks, providing to a diverse customer base.

An additional crucial feature is the straightforward user interface, which simplifies the payment process for customers, making it easily accessible and intuitive. This convenience of usage is enhanced by robust assimilation abilities, enabling smooth connection with numerous e-commerce systems and point-of-sale systems. Lots of settlement portals supply customizable checkout experiences, allowing companies to line up the payment process with their branding.

Real-time reporting and analytics are additionally essential attributes, giving vendors with insights into transaction fads and client habits, which can inform business strategies. Last but not least, scalability is a crucial particular, enabling payment portals to expand along with an organization, fitting enhanced transaction quantities without jeopardizing performance. In general, these vital attributes highlight the value of selecting a settlement entrance that aligns with organization requirements and enhances the overall client experience

Safety Steps in Repayment Processing

Making sure safety and security in repayment handling is vital for both vendors and customers, as it safeguards sensitive economic info versus fraud and cyber dangers. Settlement entrances employ diverse security look at this web-site steps to develop a robust structure for protected purchases.

Additionally, payment entrances make use of Secure Outlet Layer (SSL) technology to develop secure links, additionally shielding data traded between the seller and the customer. Tokenization is another vital procedure; it replaces sensitive card details with an one-of-a-kind identifier or token, minimizing the threat of information breaches.

Advantages for Companies

Businesses can considerably profit from the combination of settlement entrances, which enhance the transaction process and enhance operational performance. Among the main benefits is the automation of settlement handling, decreasing the requirement for manual intervention and minimizing human error. This automation allows organizations to concentrate on core activities rather than management tasks, eventually boosting productivity.

Furthermore, payment portals help with different settlement methods, including charge card, digital purses, and financial institution transfers. This flexibility satisfies a more comprehensive customer base and motivates higher conversion rates, as consumers can choose their preferred payment method. Moreover, settlement portals usually provide thorough reporting and analytics, making it possible for organizations to track sales patterns and client behavior, which can inform calculated decision-making.

Cost-effectiveness is one more significant advantage. By reducing purchase costs and enhancing the payment procedure, organizations can enhance their profit margins. Moreover, payment gateways boost protection measures, safeguarding delicate financial info and lowering the risk of scams. This not just safeguards business's track record yet also promotes trust fund among clients. On the whole, integrating a repayment portal is a strategic step that can lead to enhanced growth, success, and effectiveness chances for services.

Enhancing Customer Experience

Exactly how can repayment portals elevate the client experience? By simplifying the settlement process, repayment portals significantly enhance the overall buying trip.

In addition, payment gateways support multiple payment techniques, including bank card, digital purses, and financial institution transfers, satisfying varied customer preferences. This versatility not only satisfies the needs of a broader target market but additionally cultivates a feeling of depend on and fulfillment among users.

In addition, a safe and secure payment atmosphere is paramount. Settlement portals employ my response innovative file encryption technologies, guaranteeing consumers that their delicate info is secured. This level of security develops confidence, motivating repeat business and consumer loyalty.

In addition, numerous settlement entrances supply real-time purchase updates, allowing clients to track their repayments instantly. This openness boosts communication and lowers uncertainty, adding to a favorable client experience. On the whole, by executing a reliable and protected repayment entrance, companies can dramatically improve client satisfaction and loyalty, inevitably driving development and success in an open discover here market.

Verdict

In recap, the implementation of a repayment gateway presents numerous benefits for businesses, including structured purchase procedures, enhanced safety and security, and thorough analytics. These systems not just promote varied payment methods but also dramatically enhance client trust fund and contentment. By reducing cart desertion rates and enhancing operational efficiency, organizations can attain greater conversion prices and raised profitability. Ultimately, repayment entrances act as vital devices for contemporary business intending to thrive in an affordable digital marketplace.

Additionally, repayment portals assist in a wide range of settlement techniques, consisting of credit report cards, debit cards, and digital purses, providing to a diverse consumer base.

Numerous settlement portals use personalized checkout experiences, enabling organizations to align the payment procedure with their branding.

Additionally, repayment gateways promote different payment approaches, including credit history cards, digital pocketbooks, and financial institution transfers. By enhancing the settlement procedure, repayment portals significantly boost the overall shopping trip.Moreover, many settlement portals use real-time deal updates, enabling clients to track their settlements quickly.

Report this page